by TechBear | May 31, 2023 | News

KEITH KNOX, Los Angeles County Treasurer and Tax Collector, is in the process of mailing approximately 152,000 Notices of Delinquency (Notices) to Los Angeles County property owners who have not paid their Annual and/or Supplemental Secured Property Taxes in full for...

by TechBear | Jan 13, 2023 | News

SACRAMENTO – Californians impacted by winter storms are now eligible to claim a deduction for a disaster loss and will have more time to file their taxes. “Whether it’s more time to file your taxes or getting a deduction, this tax relief will support Californians who...

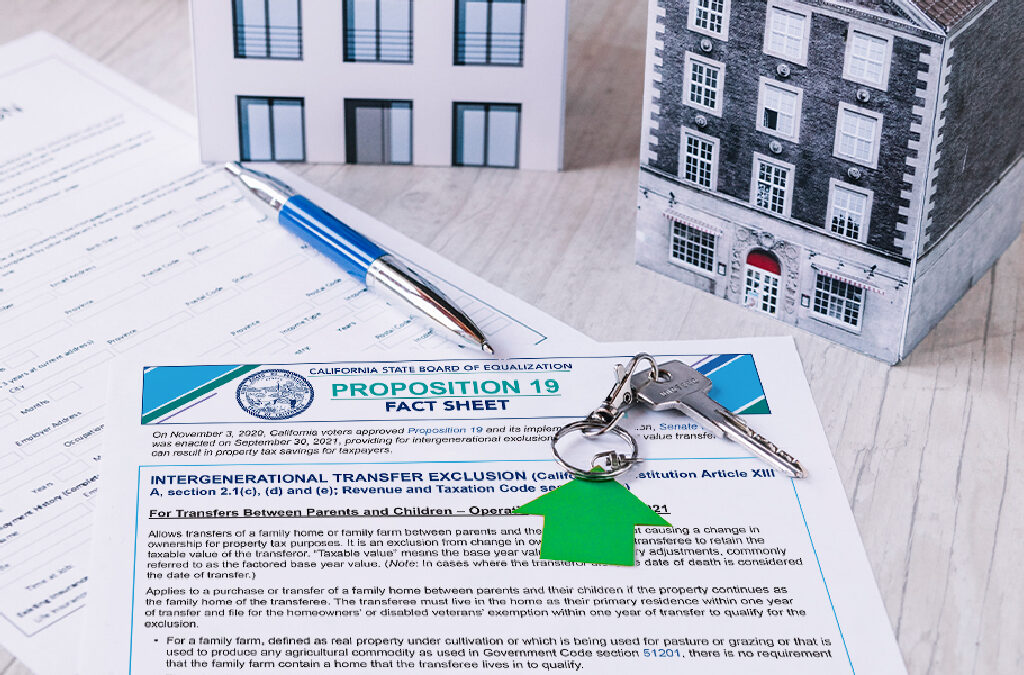

by Johnathan Razbannia | Dec 23, 2020 | News

On November 3, 2020, California Residents passed Proposition 19 (2020) The Home Protection for Seniors, Severely Disabled, Families, and Victims of Wildfire or Natural Disasters Act. Proposition 19 allows homeowners who are over 55, disabled or victims of natural...

by Johnathan Razbannia | Jul 21, 2020 | News

Dear Property Owner, I hope all is going well and you are staying safe and healthy. The global pandemic will have far reaching economic implications for landlords and tenants across the nation especially in the State of California. In efforts to curb the economic...

by Johnathan Razbannia | Jul 21, 2020 | News

California’s property tax laws allow the Assessor to adjust the assessed value of a property following destruction of real or personal property caused by a calamity or misfortune. To be eligible for disaster relief, a property must have suffered damage valued at...

Recent Comments